nh meals tax change

Advertisement Its a change that was proposed by Gov. The states meals and rooms tax will drop from 9 to 85.

2022 Sales Tax Holidays Back To School Tax Free Weekend Events

A 9 tax is also assessed on motor.

. By law cities towns and unincorporated places in New Hampshire are supposed to get 40 of the meals and rooms tax revenue but that became less certain after the 2009 recession. The state meals and rooms tax is dropping from 9 to 85. Download or print the 2021 New Hampshire Form CD-100 Meals and Rentals Request to Update or Change License for FREE from the New Hampshire Department of Revenue.

Meals and Rentals Tax. The tax is assessed upon patrons of hotels and restaurants on certain. October 1 2021.

Chris Sununu in this years budget package which passed. CHAPTER Rev 700 MEALS AND RENTALS TAX. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0.

New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023. Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

1 and HB 2 which contained numerous changes to the states business tax system for taxable periods beginning on or after. Menus are subject to. The NH Collection Berlin Mitte am Checkpoint Charlie hotel formerly known as NH Berlin Mitte Leipziger Strasse is located on.

PART Rev 701 DEFINITIONS. This budget helps consumers by reducing the Meals and Rooms Tax from 9 to 85 its lowest level in over a decade. The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5.

On June 28 2021 Governor Sununu signed HB. Nh meals tax change Saturday June 11 2022 Edit. Concord NH Today Governor Chris Sununu issued the following statement as the reduction in the Meals and Rooms Tax from 9 to 85 takes effect today.

Ethan Dewitt-New Hampshire Bulletin. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. This budget helps small businesses by reducing the Business.

Document 6690 effective 2-21-98 made extensive changes to the wording format. The BPT rate would be cut from the current 77 to 76 this year. The 136 billion budget cuts the rate of both the business profits tax and the business enterprise tax.

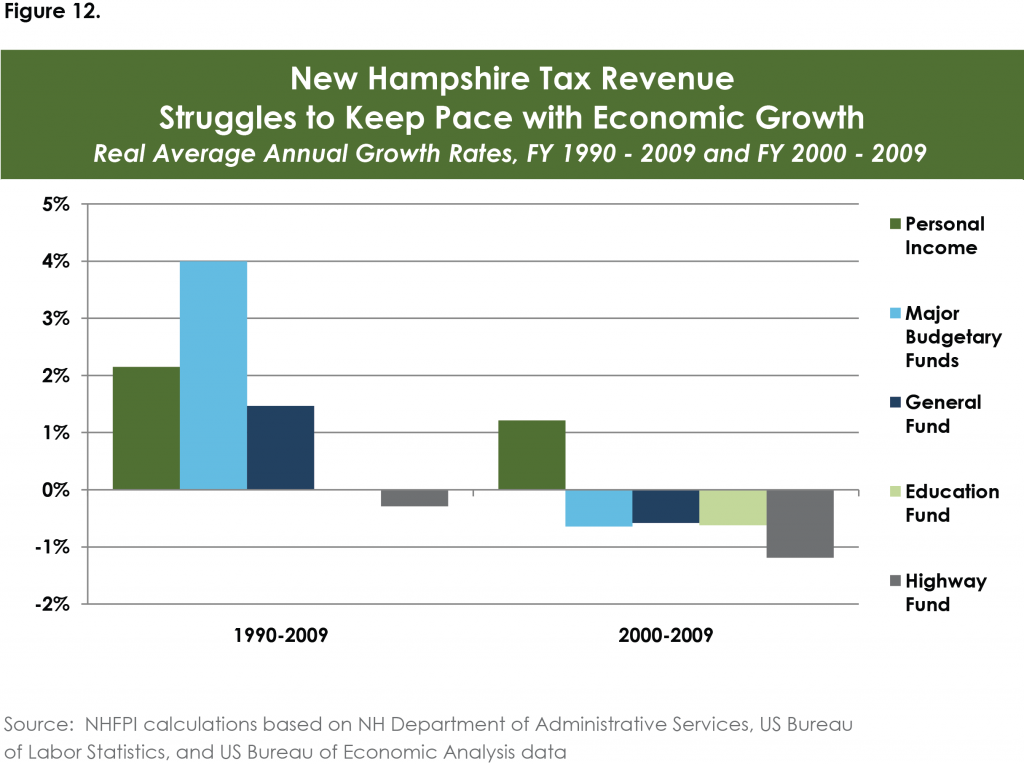

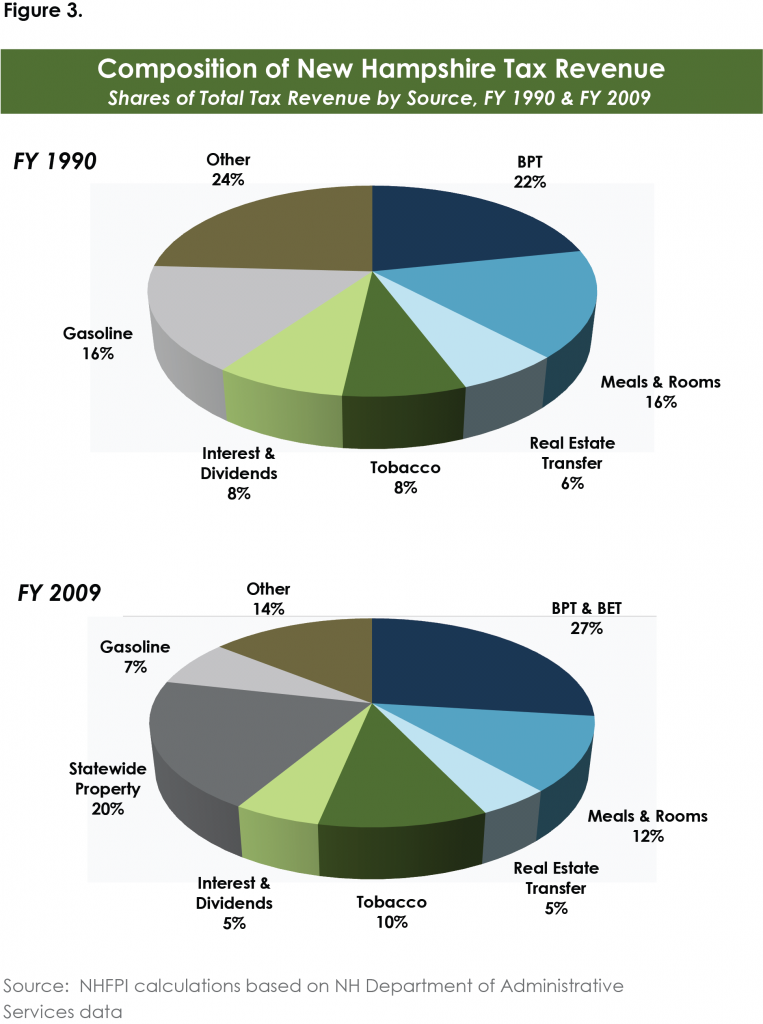

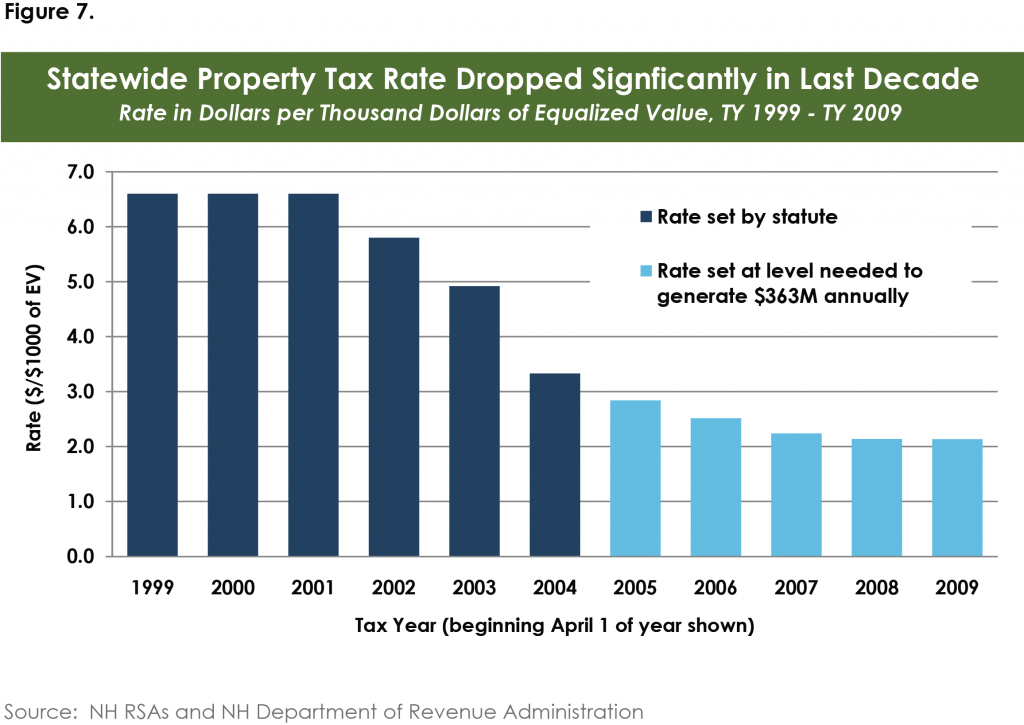

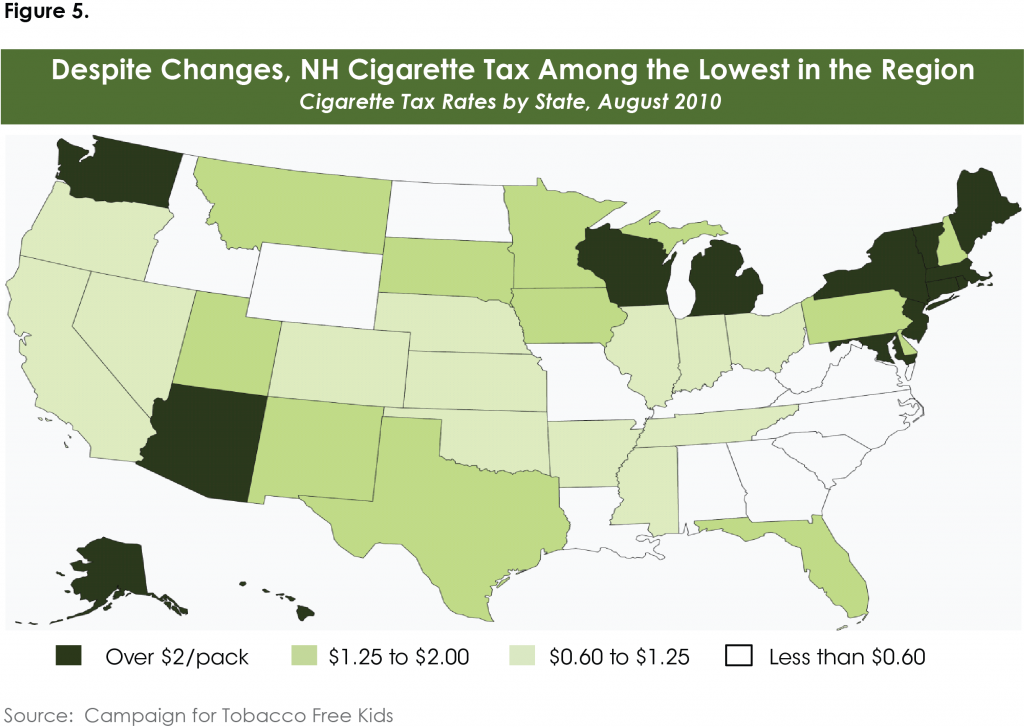

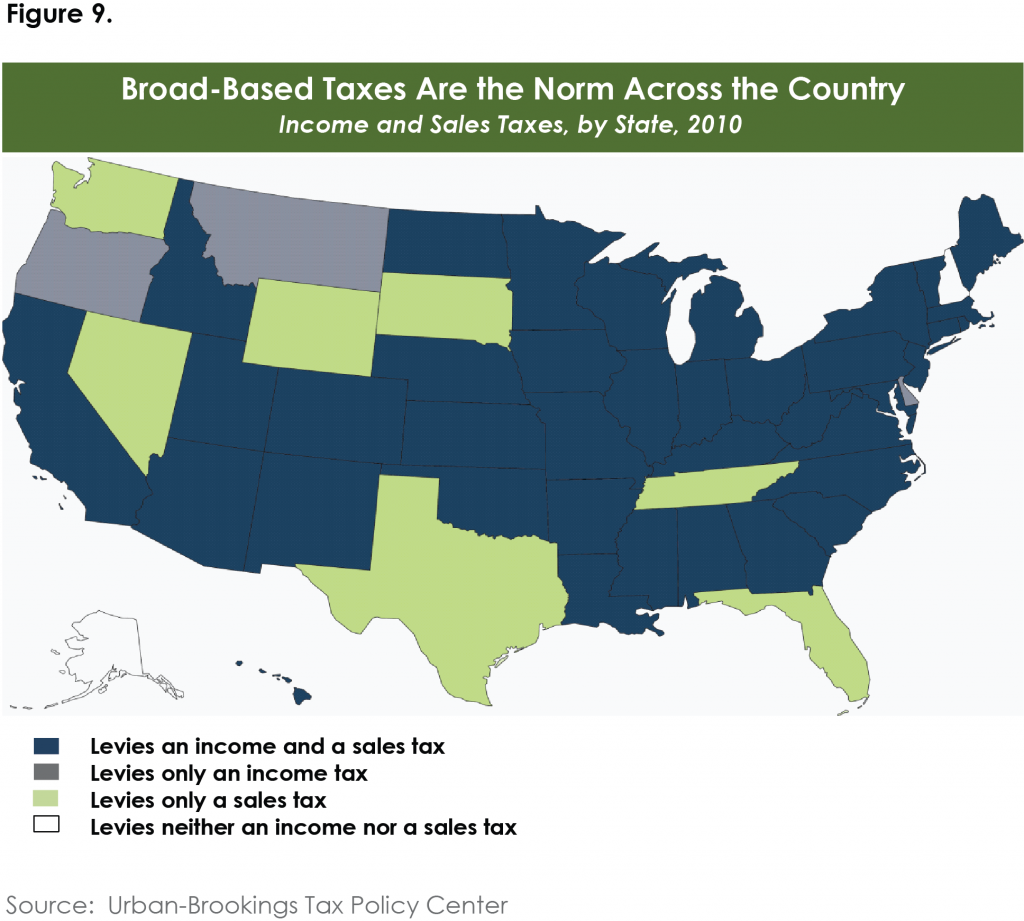

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Sales Tax On Grocery Items Taxjar

A Cfo S Guide To Tax Compliance In 2021 Netsuite

Pin By Gena Teel On Places To Visit Chorizo And Potato Food Menu

Everything You Need To Know About Restaurant Taxes

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Taxtips Ca 2021 Sales Tax Rates Pst Gst Hst

New Hampshire Meals And Rooms Tax Rate Cut Begins

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Different Types Of Payroll Deductions Gusto